The economics of BharatPe, explained

Introduction

“We were only five guys working out of college dorm rooms and only one of us really knew how to code. None of us had ever built a platform, put aside a payment API. We went to a small college in Bhavnagar, Gujarat, and hired four interns. Within a month, we had our own UPI payment processing module up and running. The first version just created a QR code and sent out push notifications every time a payment was received. The team relied heavily on the BHIM app for the payments,” said Bhavik Koladiya, Group Head for Product and Technology at BharatPe in an interview to YourStory.

With the advent of the transformative UPI technology (the instant bank-to-bank transfer system), fintech startups had sprouted all over the country. They were fighting to capture market share in a country with over 300 million internet users back then (and with over 600 million today!).

Big guns like Paytm, PhonePe, Google Pay and Mobikwik were ready to disrupt the nascent digital payments industry in India. So much so that it resonated the telecom sector post its golden era, an article in Tech crunch notes. BharatPe was a little late to join this bandwagon.

Ashneer Grover, ex-CFO of Grofers alongwith Shashvat Nakrani founded BharatPe in mid-2018 with a simple proposition, an inter-operable QR code for merchants.

The Beginning

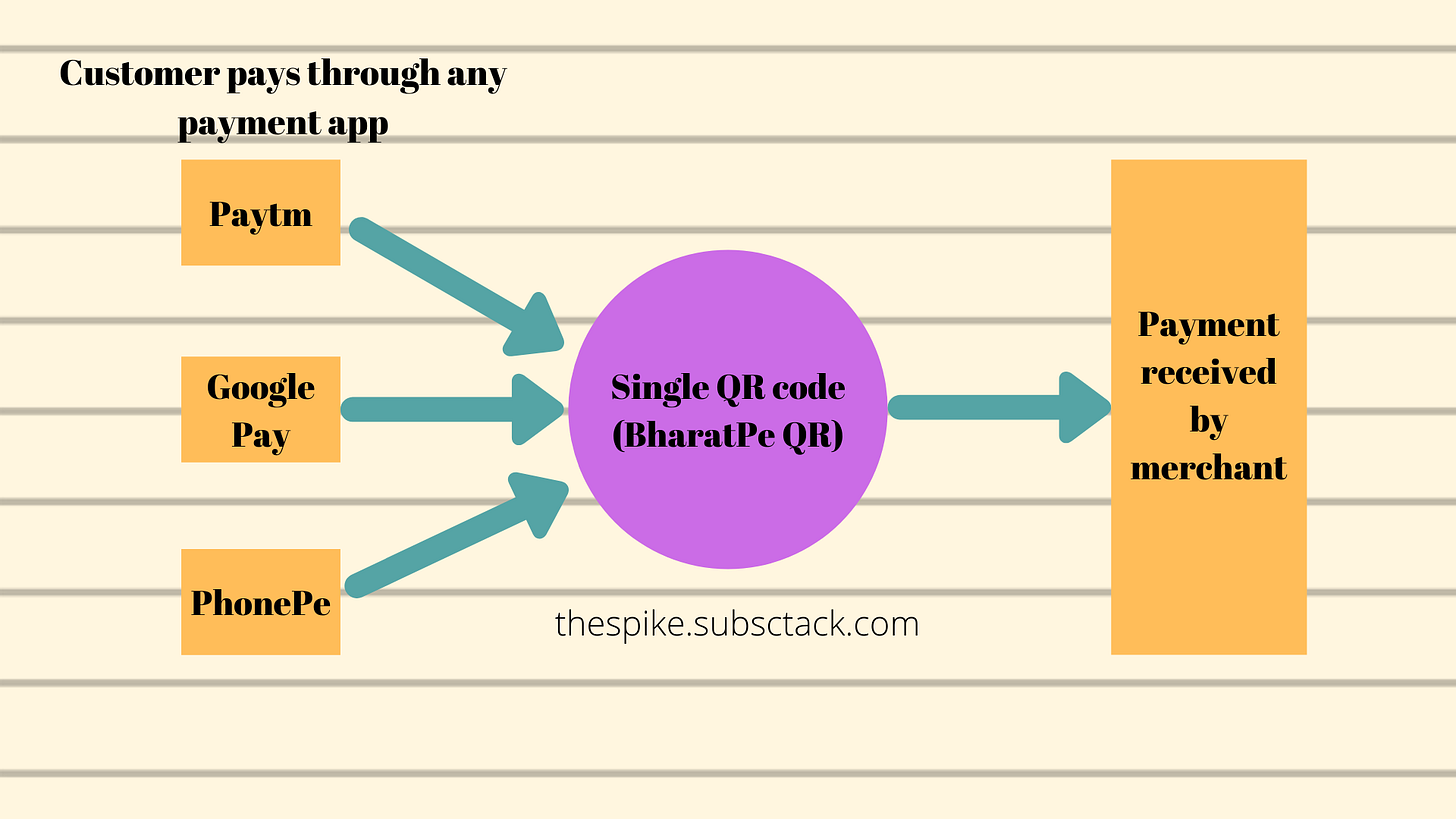

BharatPe was the first to launch an interoperable QR code. This enabled their customers (majorly small businesses) to accept payments from any of the numerous mobile wallets like Paytm, PhonePe, Google Pay, BHIM plus over a 100 other UPI apps. Before this, all payment platforms used to promote their own apps and QR systems. So, earlier a QR code issued by Paytm could only accept payments when the payer uses his Paytm wallet.

Further, BharatPe even promised to never charge MDR to its merchants. MDR i.e. 'Merchant Discount Rate' is a payment processing fee charged from merchants on every transaction.

All this, plus BharatPe’s swift execution helped it to onboard over 6 million customers in over a couple of years’ times. Today it is the 3rd largest player in the Merchant UPI payment acceptance space. That’s greater than the combined transaction volume of Jio, Zomato, Swiggy, CRED, FlipKart, CashFree, IRCTC and MPL in the UPI P2M category.

But how did they get here, especially in an already overcrowded and overfunded digital payments ecosystem? So, what worked was its unswerving commitment to focus on the merchant ecosystem. So, when all the biggies in the sector were struggling to serve the consumer first, BharatPe smartly built a gigantic business focusing just on merchants.

But then, tapping the very huge, unfragmented SME sector in India is an arduous job. BharatPe has built its own ‘Fleet on Street’ to tackle this. It has its agents run over to a lot of local kirana shops, restaurants, and all other small businesses. These agents explain the shop owners the advantages of an 'all-in-one' QR code and can onboard a merchant in a matter of minutes (this, compared to the industry standard of 15 days!).

This approach by BharatPe, however simple and obvious it sounds, is what led it to become the mammoth organization it is today. Majority of the startups, fail to support their massively technology aided approach with that of an offline and physical infrastructure. In my mind, building Grofers would have helped Ashneer Grover associate importance to having an offline-led approach to capture the Indian SME market.

Lately, BharatPe has also launched its PoS offering, called BharatSwipe. This would help merchants accept card payments, with an option for zero transaction fees.

Now, how does this work? BharatPe charges a refundable security deposit on the issue of these machines to the merchants. And then, for absorbing the cost of the MDR not charged on every transaction processed through the BharatSwipe card machine, merchants will have to sacrifice instant settlement of payments received through it for 15 days. BharatPe would monetize this by making interest on these 15-day deposits.

But for BharatPe, the path to profitability lies more on the lending side of its business. Especially since the company has vowed to never charge a dime for its payments services.

The Lending Play

There is no money to be made in payments in India.

~Ashneer Grover

BharatPe has tremendous data with regards the cashflows of the merchants registered with it, thanks to its free QR code distribution strategy. It processes this information to assess lending risk for respective merchants. And since 2019, it has shifted focus on monetizing their merchants’ base by offering them loans.

It began by partnering with Mumbai-based NBFC Apollo Finvest on a 100% FLDG model. FLDG stands for “first-loss default guarantee”. It implies that the agent (here, BharatPe) which brings borrowers to the bank/ NBFC will bear the entire loss in case the borrower (here, the merchant) fails to pay.

Later BharatPe moved on to the P2P (peer-to-peer) model for lending. This approach has worked well for the company this far. With a P2P model, BharatPe can offer its customers not only credit but also a place to park their excess funds.

What is the P2P approach, though? To understand this well, let us take an example of two merchants- Mr. Patel and Mr. Kumar. Mr. Patel has excess funds so he can invest them in an interest account with BharatPe which would earn him 12% p.a. Now, Mr. Kumar who needs funds, can borrow money from BharatPe’s platform at around 24% p.a. Here, amount deposited by Mr. Patel can be used to lend to Mr. Kumar. And with millions of such small merchants, BharatPe is well poised to set up a successful P2P lending business.

For the 24% interest charged from Mr. Kumar, 12% will be used to pay to Mr. Patel, 3% to the NBFC and BharatPe gets the rest.

But as good as it may sound, this approach is a bit questionable. Since the money deposited is being used to lend to some other merchant, it is not as safe as a bank fixed deposit (which are considered secure. Really, why?). Anyways, the RBI has certain guidelines on this approach. These are too technical to go into here. You can read in detail here in this article from ET Prime.

Further, BharatPe has recently raised some debt and equity from a clutch of investors to further intensify its lending business. A month ago, it even raised $108 million in equity funding in tandem to its aim of building an ambitious INR 5,000 crore loan book. Though this appears to be a far-fetched dream now. Especially, considering how its dreams for an NBFC license got crushed by the RBI.

Challenges

Particularly in the lending sector, control over cost of capital can prove to be defining factor for any business. This is why various fintech startups strive to get a NBFC license. But for BharatPe, the RBI returned its NBFC application, likely because it had received investments from funds domiciled in Mauritius. Tax-friendly jurisdictions like Mauritius are however a very common route for VCFs to pour money in the country.

Of late, BharatPe's Grover has set its eyes on getting a banking license. BharatPe alongwith Centrum Wealth Management have submit its bid for acquiring the debt-ridden PMC bank. It is unlikely of the RBI to accept BharatPe's proposal, especially when it has already rejected BharatPe’s NBFC application. Albeit, its partnership with Centrum does add some weight to the bid.

Incase, this goes through, BharatPe intends to pivot PMC bank to a purely digital enterprise as per an article in MoneyControl. This will help it with sourcing cheap capital to aid its lending business.

Conclusion

BharatPe bleeds money on every payment it processes (and so does every other UPI platform in the country, currently. Read more here and here). Albeit it has managed to keep its burn rate to as low as $3 million a month, as claimed by Grover in an episode of Paisa Vaisa. This is impressive compared to other digital payment apps in the country.

But, this still is not enough. To become profitable, BharatPe needs to monetize its massive user base. And it has since tried offering various services.

It has started with offering credit cards to merchants. Plus, it has tested its wholesaler financing product. Further, BharatPe has even piloted its loyalty points program. All in all, BharatPe is scrambling for ways to make money.

For BharatPe, the biggest money-making avenue proven till now is lending. BharatPe has its reach to millions of merchants. Traditionally, these mom and pop shops don't find it easy to avail formal credit. Hence, they source their capital requirements locally from moneylenders and pay interest rates as high as 3% a month.

BharatPe is well placed to provide loans to such merchants. Definitely, it will have to review its cost structure to appear competitive. A banking or NBFC license will surely help.

And as far as demand goes, that shouldn't be a problem for BharatPe. Among various factors of production, namely land, labour, capital and entrepreneur; capital is the scarcest in India. So, when BharatPe comes with the option of easy credit and at competitive rates, merchants will likely cling to it.

However, the supply side may pose a problem. To build an INR 5,000 crore loan book, BharatPe will first require that amount in their books. Right now, it is unclear how BharatPe intends to source this mammoth amount.

Nevertheless, BharatPe is well poised to disrupt the Indian lending space (and maybe more!). It already is a behemoth valued at $900 million in less than three years from when it started. Over time, it is likely to grow only bigger. What do you think?